imagine360 medical plan

Medical ID Cards

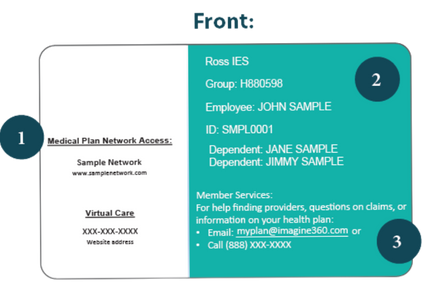

Imagine360 will send your medical ID card in the mail after you enroll. If you have not received your card or have lost it, you can access a digital copy at miBenefits.imagine360.com. Your group number is H880598.

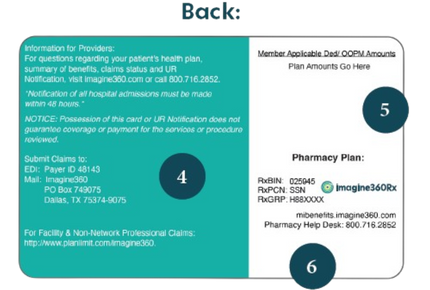

Get to Know your Medical ID Card

MEDICAL AND PHARMACY

Imagine360 Medical Plans

PHARMACY

Pharmacy Benefits

When you’re enrolled in an Imagine360 medical plan, you have access to a network of pharmacies through VeracityRx that provides prescription drugs and related supplies at discounted rates.

Health Savings Account (HSA)

A Health Savings Account (HSA) from Optum Bank can be paired with one of the high deductible health plans.

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) through CBIZ Flex lets you set aside pre-tax dollars for qualified expenses. FSA funds are use it or lose it and must be spent by the end of the year calendar year.

Life and AD&D

Life and AD&D insurance provides financial protection by offering benefits in the event of death or dismemberment. Your employer provides you with a Basic Life and AD&D insurance benefit of $25,000 at no cost to you. You may also purchase additional Voluntary Life and AD&D insurance for you and your dependents.

Disability

Voluntary disability insurance provides financial protection by offering benefits in the event of an inability to work due to injury or illness. Short-Term Disability (STD) covers 60% of your weekly earnings up to $1,000 per week. Long-Term Disability (LTD) covers 60% of your monthly earnings up to $4,000 per month.