imagine360 medical plan

Medical ID Cards

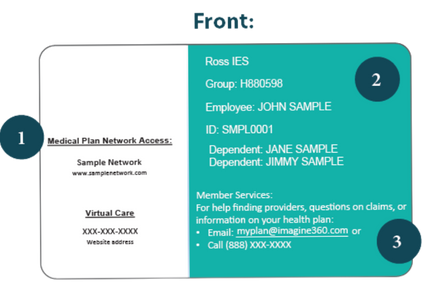

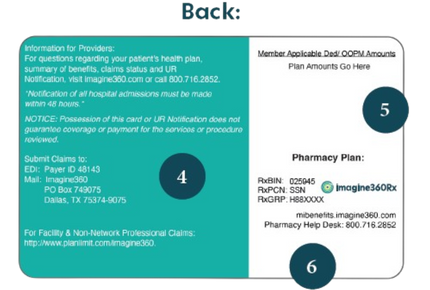

Imagine360 will send your medical ID card in the mail after you enroll. If you have not received your card or have lost it, you can access a digital copy at miBenefits.imagine360.com. Your group number is H880598.

Get to Know your Medical ID Card

MEDICAL AND PHARMACY

Imagine360 Medical Plans

MEDICAL PLANS

Kaiser Permanente

Pharmacy Benefits

Those enrolled in an Imagine60 medical plan will have pharmacy coverage through VeracityRx. You can call the service team at 1-888-388-8228 with any questions. Those enrolled in a Kaiser Permanente plan will have pharmacy coverage through Kaiser.

Employee Assistance Program (EAP)

Your Employee Assistance Program (EAP) is a free benefit available to you and your family, offering resources to support your mental well-being. As part of this program, you have access to up to five counseling sessions each year at no cost.

FitPros

FitPros LIVE is your all-in-one wellbeing hub, giving you unlimited access to expert-led fitness, mindfulness, and personal growth sessions anytime, anywhere. With this free program, you can explore live and on-demand classes, right from your phone or computer. Use passcode: thrive to get started.

Health Savings Account (HSA)

A Health Savings Account (HSA) from Optum Bank can be paired with one of the high deductible health plans.

Flexible Spending Account (FSA)

A Flexible Spending Account (FSA) through CBIZ Flex lets you set aside pre-tax dollars for qualified expenses. FSA funds are use it or lose it and must be spent by the end of the year calendar year.

Life and AD&D

Life and AD&D insurance provides financial protection by offering benefits in the event of death or dismemberment. Basic Life and AD&D is paid by your employer and includes 1x your annual salary up to a maximum of $100,000. You may also purchase additional Voluntary Life and AD&D insurance for you and your dependents.

Disability

Disability insurance provides financial protection by offering benefits in the event of an inability to work due to injury or illness. Short-Term Disability (STD) covers 60% of your weekly earnings up to $4,000. Long-Term Disability (LTD) covers 60% of your monthly earnings up to $15,000 per month. Both insurances provided by your employes at no cost to you!

Additional Benefits

Employee-paid additional benefits are available to help offset costs during an emergency.

Legal and Identity Theft Benefit

This plan administered by MetLife provides you with unlimited access to attorneys for services like wills, contracts, real estate, and identity theft, all for a simple payroll-deducted monthly premium.